COVID-19 appears to have spurred health-tech innovation

While the health-tech ecosystem has been growing steadily, activity was amplified amidst the COVID-19 pandemic. Through rapid landscaping we identified 1276 health-tech start-ups operating across Africa supporting health care delivery and distribution[1]. 60% were founded in last 5 years.

However, 2020 represented an unusual surge in innovation: 22% of all companies tracked were founded this year amid the pandemic – the highest of any year in our data base. During this time, innovators saw opportunities to fill critical gaps; online pharmacy and delivery companies ensured end users still had access to essential medicines and medical supplies amid restrictions, while telemedicine innovators provided channels for remote consultations to maintain access to healthcare and helped relieve pressure on over-burdened healthcare facilities and providers.

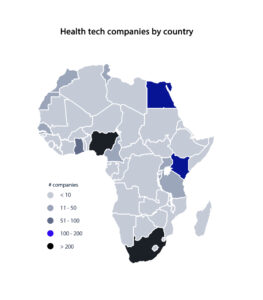

Innovation in health-tech appears to be concentrated in the continent’s largest tech hubs: Nigeria and South Africa, two of Africa’s largest economies and tech ecosystems, jointly account for 46% identified health-tech start-ups, with Kenya and Egypt trailing shortly behind.

What are companies doing?

What are companies doing?

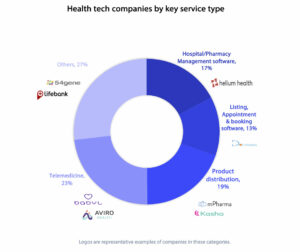

Telemedicine appears to be the most common service offered by start-ups founded within the last five years. COVID-19 appears to have accelerated this trend; 33% of identified telemedicine start-ups were founded amid the pandemic. Babyl (Rwanda), Vezeeta (Egypt), DRO Health (Nigeria) & Zuri Health (Kenya) are examples of growth and early-stage innovators in this space. Investors are betting on the size of the opportunity: telemedicine start-ups received 20% of funding for African health technology start-ups through 2020.

It remains to be seen if African governments will incorporate telemedicine innovators into national healthcare delivery strategies and schemes. Apart from Rwanda where the government has partnered with Babyl on a national scale, telemedicine innovators across the continent are not yet integrated with government purchasing models and typically rely on out-of-pocket payments by end users for revenues and growth.

To ensure reliable access to quality-assured drugs, product distribution start-ups are implementing solutions across medical supply chains. While mPharma expands its scope and scale with backing from investors such as CDC Group, a host of other start-ups are also growing in this space. DrugStoc (Nigeria) and Medsource (Kenya) are deploying inventory management and marketplace solutions to connect pharmacies and clinics to trusted supply of products from manufacturers and distributors, helping ensure availability, reduce price variability and more. In Nigeria, Field Intelligence has worked with the government to optimize supply chains and reduce the frequency of stockouts for antimalarial drugs at point of care by 52%.

Start-ups like Rocket Health (Uganda) and PharmaGo (South Africa) are also facilitating access for end users through online pharmacy operations. Jointly, these product distribution start-ups have profound impact on reducing the prevalence of counterfeit medication, by offering tech-enabled alternatives to sourcing medication from open drug markets. Physical retail pharmacy chains such as Goodlife Pharmacy (Kenya), HealthPlus (Nigeria) and MedPlus (Nigeria) are also launching online pharmacy operations leveraging their established brand names, inventory and logistics infrastructure.

Hospital, patient and pharmacy management software solutions are also developing digital tools to streamline and automate processes. Helium Health, an emerging leader in the space, has raised $12.2 million in investment, expanded to three African countries and acquired a UAE-based subsidiary since launching in Nigeria five years ago. Innovators are also providing pharmacies with tools to streamline stock management and ordering, track patient purchasing records and manage customer databases. Innovators like ComPharm (South Africa) and PharmaCare-PHMS (Egypt) are notable examples in this space.

Mitigating factors

Despite growing evidence and further promise of their impact on improving health outcomes, health-tech start-ups continue to face some hurdles. Resolving them will be essential to maximizing the public health potential of technology-driven innovations.

Regulation is under-developed, inhibiting growth. Innovators often face regulatory uncertainty as they build and attempt to scale solutions. For example, online pharmacies operate in a gray area as a recent survey by the International Pharmaceutical Federation showed only 8% of African ccountries indicated the existence of online pharmacy regulations. In Nigeria, regulatory guidelines for online pharmacies only came into effect in January 2022, and there are still unresolved concerns around its implementation. The lack of regulation can limit innovators’ ability to garner investment and expand – locally and regionally.

Funding remains limited, and exclusionary. The latest funding data suggest that investment in health-tech start-ups in Africa grew by 81% in 2021, however, the sector’s share of total start-up funding in Africa remains less than 10%. Our research also shows that among product distribution start-ups in Nigeria, Ghana, Kenya and Uganda, funding is heavily skewed towards companies whose founders have ties to high-income countries. Amongst this sub-set of companies, most founders who lack ties to high-income countries hit a fundraising ceiling of only $150,000 over the lifetime of their businesses.

Systemic support for social innovation is needed. Our research indicates there is a gap in public investment to support innovation in health care delivery and distribution in Africa. In many OECD countries, public programs exist at the continent, national, local and city level to support social innovation and generate high-value jobs. One examples is the National Institute of Health (NIH) commercialization fund which supports health tech start-ups to commercialize innovations, register patents, facilitate pilot studies, and prepare for regulatory approval. Africa needs systemic public investment mechanisms such as these to develop local companies that can power next-generation health systems.

Looking ahead

Health-tech ecosystems are developing rapidly across the continent, with start-ups balancing social impact and commercial viability. Their emergence to shore up perennial gaps is pivotal if Africa’s health systems are to leapfrog long-running challenges. But the potential they offer must be fostered through deliberate action at high-levels of governments across the continent to provide innovation-friendly environments and through concerted action by investors and donors to provide critical financing to drive scale.

As Dr. Muhammad Pate, a global director at World Bank, writes in a recent essay, seizing the opportunity of digital health technology and innovations is vital to shaping the emergence of a bright future for health in Africa.

[1] This rapid landscape excludes companies related to body fitness tech, cannabis health tech, veterinary health tech, road transport assistive tech, consumer health electronics, healthcare IT Food Tech, and eye tracking assistive tech. Additionally, companies older than 20 years were excluded.